Securing Your Assets: Trust Structure Knowledge at Your Fingertips

In today's complicated monetary landscape, making sure the safety and development of your properties is critical. Depend on structures serve as a cornerstone for guarding your wide range and legacy, offering a structured strategy to property security.

Significance of Trust Fund Structures

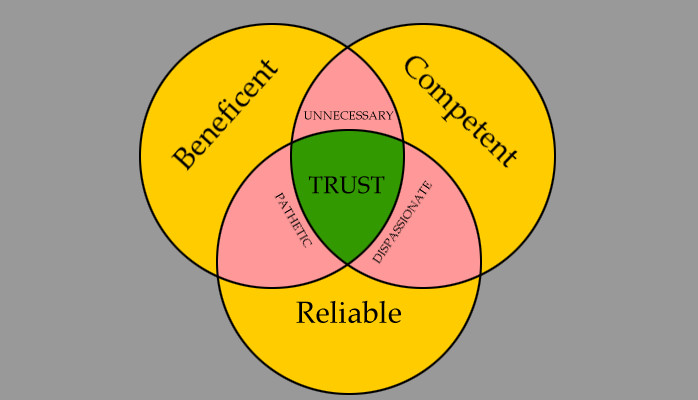

Trust fund foundations play an essential function in developing reputation and fostering strong relationships in numerous specialist settings. Structure trust fund is crucial for organizations to flourish, as it creates the basis of successful cooperations and collaborations. When trust fund exists, individuals feel more confident in their interactions, leading to boosted productivity and performance. Count on foundations work as the cornerstone for honest decision-making and clear interaction within organizations. By focusing on trust, businesses can develop a positive work culture where staff members really feel valued and valued.

:max_bytes(150000):strip_icc()/trust-fund-4187592-1-58df0cb75cbc432090ea169f30193611.jpg)

Advantages of Expert Guidance

Building on the structure of rely on specialist connections, looking for specialist guidance supplies important benefits for individuals and companies alike. Expert advice provides a riches of knowledge and experience that can help navigate complicated economic, legal, or calculated challenges easily. By leveraging the expertise of professionals in numerous areas, individuals and companies can make enlightened choices that align with their goals and goals.

One significant advantage of specialist assistance is the ability to access specialized understanding that might not be conveniently offered or else. Experts can supply understandings and point of views that can result in innovative remedies and opportunities for growth. In addition, functioning with experts can aid mitigate dangers and uncertainties by giving a clear roadmap for success.

Moreover, professional advice can conserve time and resources by simplifying procedures and avoiding pricey blunders. trust foundations. Professionals can offer personalized guidance tailored to certain requirements, guaranteeing that every choice is well-informed and critical. On the whole, the advantages of expert support are complex, making it a beneficial possession in protecting and making best use of assets for the long-term

Ensuring Financial Security

In the world of financial preparation, safeguarding a steady and thriving future rest on tactical decision-making and prudent investment options. Making certain monetary safety entails a complex technique that incorporates numerous facets of riches management. One vital component is producing a diversified investment portfolio tailored to private threat resistance and economic objectives. By spreading investments throughout different property courses, such as supplies, bonds, real estate, and assets, the risk of considerable monetary loss can be minimized.

In addition, preserving a reserve is necessary to protect against unforeseen expenditures or revenue disturbances. Professionals recommend alloting 3 to six months' worth of living costs in a liquid, conveniently accessible account. This fund serves as a financial safeguard, offering comfort during stormy times.

Routinely reviewing and readjusting economic plans in feedback to transforming situations is likewise extremely important. Life events, market variations, and legislative modifications can affect financial stability, underscoring the importance of recurring evaluation and adjustment in the pursuit of lasting financial security - trust foundations. By carrying out these approaches attentively and constantly, people can strengthen their economic footing and job towards a much more secure future

Securing Your Properties Properly

With a strong foundation in position for monetary security with diversification and reserve maintenance, the next critical action is guarding your possessions successfully. Guarding assets entails safeguarding your wide range from possible threats such as market volatility, financial downturns, suits, and unpredicted expenditures. One effective approach is property appropriation, which involves spreading your financial investments throughout different asset classes to lower danger. Expanding your profile can help reduce losses in one area by stabilizing it with gains in one more.

In addition, establishing a trust fund can provide a secure method to secure your possessions for future generations. Trusts can assist you regulate how your possessions are dispersed, minimize estate taxes, and secure your riches from financial institutions. By executing these approaches and seeking specialist suggestions, you can protect your possessions successfully and safeguard your monetary future.

Long-Term Property Security

Long-term asset security entails carrying out actions to secure your possessions from various threats such as economic downturns, suits, or unanticipated life occasions. One vital facet of lasting possession security is establishing a trust fund, which can provide considerable advantages in protecting your properties from financial institutions and lawful conflicts.

In addition, expanding your investment portfolio is another key technique for lasting possession protection. By spreading your investments across various property courses, industries, and geographical areas, you can minimize the Visit This Link influence of market variations on click here for info your total wide range. In addition, regularly evaluating and upgrading your estate plan is necessary to make sure that your assets are secured according to your desires in the long run. By taking a positive method to long-lasting property security, you can safeguard your riches and give monetary security for on your own and future generations.

Conclusion

In final thought, depend on structures play a vital function in safeguarding properties and making sure financial protection. Professional guidance in developing and managing depend on structures is essential for long-lasting asset security.